The Open DeFi Notification Protocol Now Supports Venus Protocol

Defi.org

Jun 9

3 min read

The Open DeFi Notifications Protocol has integrated Venus Protocol, the largest money market & synthetic stablecoin platform on BSC, with almost $800M in TVL.

Venus users can now sleep better knowing that their positions are monitored 24/7 and that they will receive real-time notifications to help them manage their risk.

The Open DeFi Notification Protocol App is available on both Apple AppStore and Google Play.

The Open DeFi Notification Protocol by defi.org is a community led initiative to provide users with decentralized and free mobile notifications for on-chain events.

The Best Way to Monitor Leveraged Positions

Venus is the largest lending & borrowing protocol on Binance Smart Chain, and top 5 overall according to defillma. Venus enables DeFi users to take collateralized loans for various activities and strategies across the DeFi space.

However, opening collateralized loans carries certain risks, primarily the risk of liquidation. Borrowers need to ensure that they do not cross their borrow limit, which can trigger a liquidation bot to close their positions to repay the debt. The borrow limit depends on the Collateral Factor and is constantly displayed on the Venus app dashboard, indicating how close the position is to potential liquidation. Once the borrow limit reaches 100% you are at risk of getting liquidated.

As we all know, the crypto market is very volatile. Extreme price movements can decrease the notional value of a collateral's token or increase the value of the borrowed currency (or both), increasing the risk of liquidation. At times such as these, borrowers can experience some sleepless nights, having to regularly monitor their position status.

Well, not anymore!

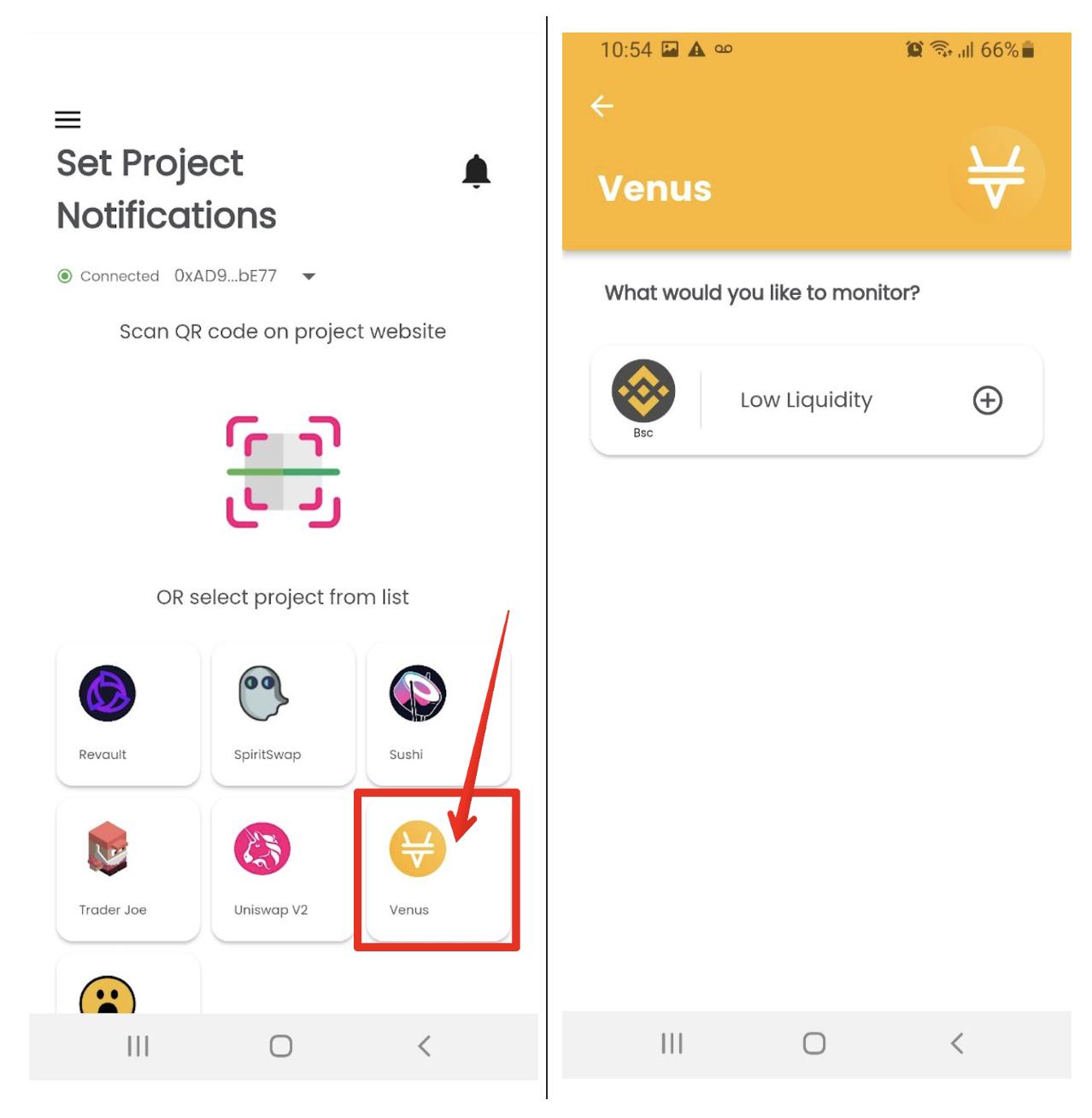

Using the Open DeFi Notification Protocol, Venus users can set up a "Low Liquidity" notification which will issue an alert when your position gets close to liquidation. In this way, users have 24/7 monitoring of their position status, and can take immediate action in order to mitigate the risk of liquidation.

A Notification Standard for Leading DeFi Projects

The Open DeFi Notification Protocol is an open initiative to provide users with decentralized and free mobile notifications for on-chain events.

Venus joins other top DeFi lending protocols, such as Alpaca Finance, supported by the Open DeFi Notification app, with liquidation risk notifications being one of the most popular use-case by the app users.

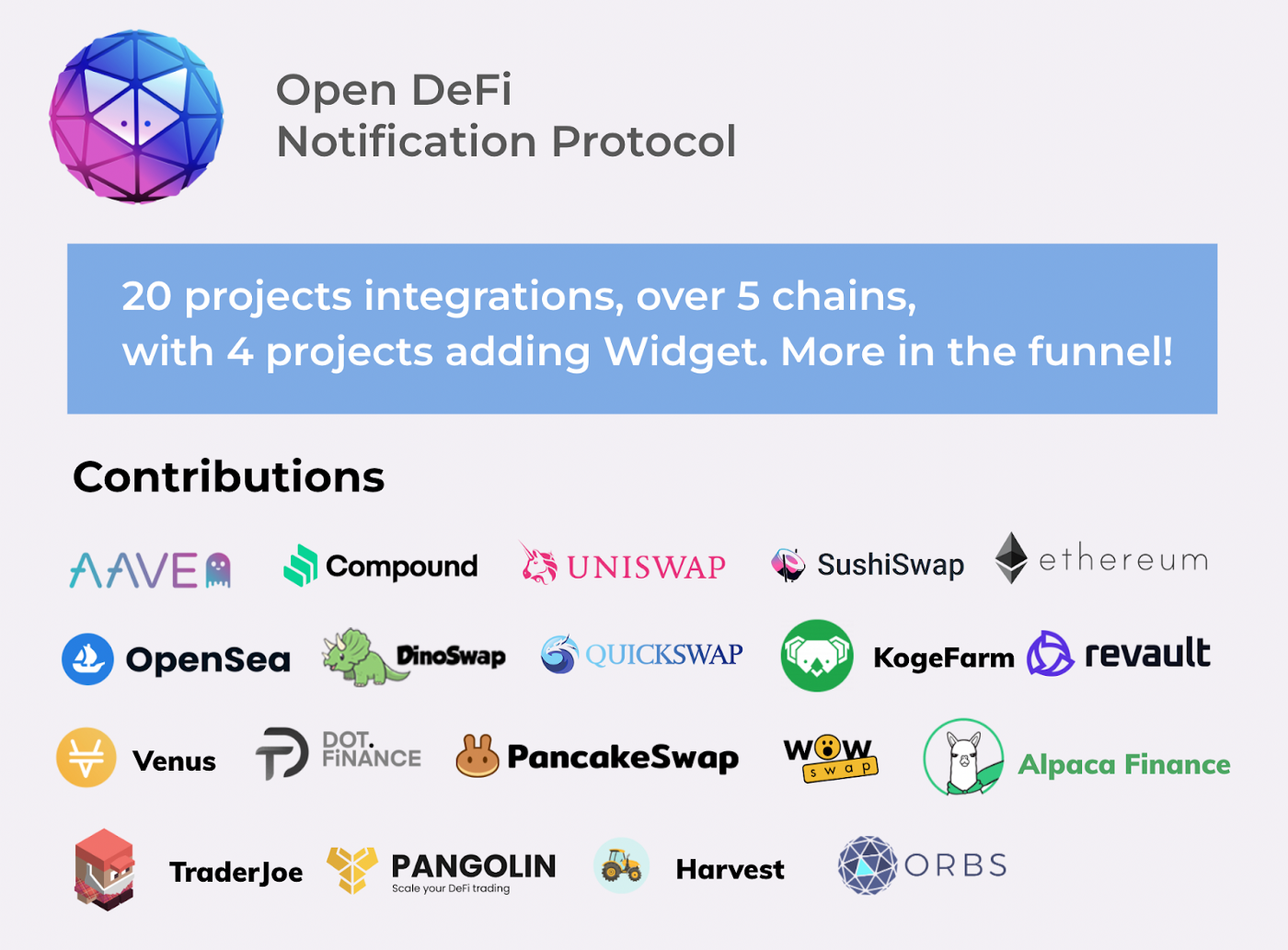

The addition of Venus makes for an impressive lineup of leading DeFi projects who have already been integrated into the Open DeFi Notification app for the benefit of their users, including among others: Aave, Uniswap, SushiSwap, QuickSwap, PancakeSwap and more...

All in all, the app supports 20 protocols across 5 networks: Ethereum, BSC, Polygon, Fantom and Avalanche!

separator

The Protocol has been implemented fully by the Orbs network and will be executed by the Orbs Guardians, making this the 1st fully decentralized implementation of a notification protocol.

Become involved and contribute:

https://github.com/open-defi-notification-protocol

Learn more about the Open DeFi Notification Protocol here.

Proudly born in the defi.org accelerator, join our Telegram channel for more updates!

separator

Please Note

The Open DeFi Notification Protocol is a beta version that is still under active development, and all underlying digital assets, blockchain networks and DeFi platforms are also subject to ongoing development, and as such, the protocol or the underlying platforms:

(a) may contain bugs, errors and defects,

(b) may function improperly or be subject to periods of downtime and unavailability,

(c) may result in total or partial loss or corruption of data or a delay or a failure to send or receive expected notifications.

Any use of any platform, application and/or services described here is at your own risk and you are solely responsible for all transaction decisions. For more information, please see the Terms of Use and Privacy Policy.